Investment Strategies for a Changing Interest Rate Environment

As 2023 progresses, changes in interest rates have significantly impacted investment strategies across various asset classes. With central banks around the world adjusting rates in response to economic conditions, investors must adapt their strategies to navigate the shifting interest rate environment. Understanding how interest rate changes affect investments and exploring effective strategies can help investors make informed decisions.

Interest rates influence investment decisions by affecting borrowing costs, asset valuations, and economic growth. When central banks raise interest rates, borrowing becomes more expensive, which can impact consumer spending and business investment. Higher rates can also lead to lower bond prices, as existing bonds with lower yields become less attractive compared to new issues.

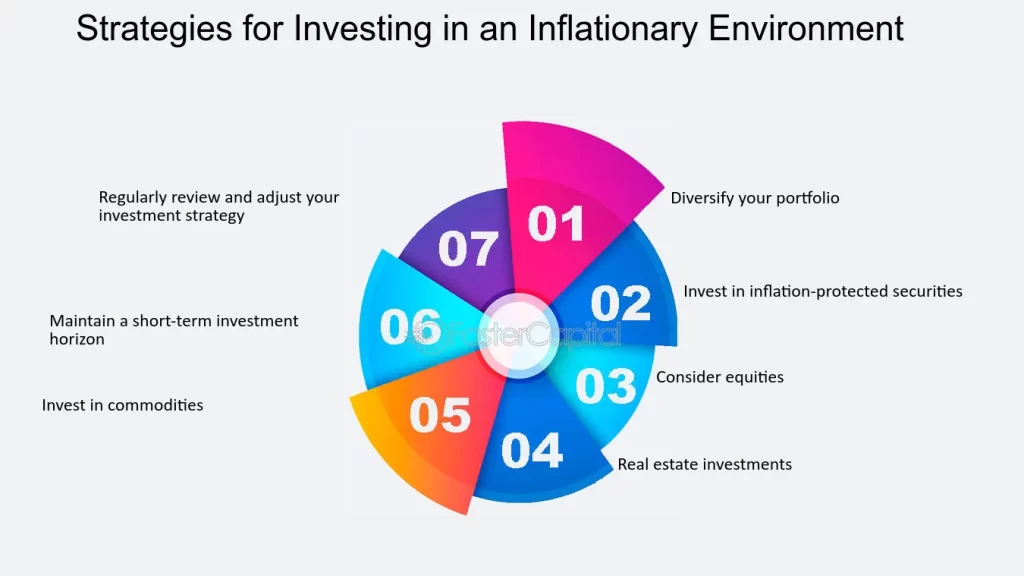

For fixed-income investors, a rising interest rate environment presents challenges. Bond prices typically decline when rates increase, leading to potential losses for bondholders. To manage this risk, investors may consider shortening the duration of their bond portfolios, focusing on shorter-term bonds that are less sensitive to interest rate changes. Alternatively, diversifying into floating-rate or inflation-protected bonds can provide some protection against rising rates.

Equity markets are also affected by interest rate changes. Higher rates can increase the cost of capital for companies, potentially impacting corporate earnings and stock valuations. Investors may adjust their equity strategies by focusing on sectors that are less sensitive to interest rate changes or by seeking companies with strong balance sheets and pricing power.

In a rising rate environment, cash and cash equivalents can become more attractive. With higher interest rates, investors may benefit from higher yields on savings accounts, money market funds, and short-term investments. Maintaining a portion of the portfolio in cash or liquid assets provides flexibility to take advantage of investment opportunities during market fluctuations.

Real estate investments are influenced by interest rates as well. Higher rates can increase mortgage costs and potentially impact property values. Real estate investors may need to reassess their strategies, considering factors such as rental income potential and property appreciation in light of changing borrowing costs.

Overall, adapting investment strategies to a changing interest rate environment involves assessing the impact on various asset classes and adjusting portfolios accordingly. By focusing on duration management, sector selection, cash allocation, and real estate considerations, investors can navigate interest rate fluctuations and position their portfolios for success.