The Rise of ESG Investing: How Environmental, Social, and Governance Factors Are Shaping Stock Markets

Environmental, Social, and Governance (ESG) investing has gained significant traction in 2023, reflecting a growing emphasis on sustainable and responsible investment practices. ESG factors are increasingly influencing stock markets as investors and companies recognize the importance of integrating these criteria into their decision-making processes. Understanding the rise of ESG investing and its impact on stock markets provides insights into this evolving trend.

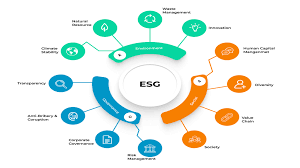

ESG investing focuses on evaluating companies based on their environmental impact, social responsibility, and governance practices. Environmental considerations include a company’s carbon footprint, resource usage, and efforts to address climate change. Social factors encompass labor practices, community engagement, and diversity and inclusion initiatives. Governance factors involve board composition, executive compensation, and transparency in corporate practices.

The rise of ESG investing is driven by several factors. Increased awareness of climate change and social issues has prompted investors to seek opportunities that align with their values and long-term objectives. Additionally, regulatory developments and corporate commitments to sustainability have further amplified the focus on ESG criteria.

Stock markets have responded to the growing demand for ESG investments by incorporating these factors into financial analysis and reporting. Many companies are now disclosing their ESG performance and sustainability strategies, providing investors with relevant information to assess their investments. This shift towards greater transparency and accountability is reshaping how companies are evaluated and valued in the stock market.

ESG investing has also led to the development of various financial products and indices that focus on sustainability. ESG-focused mutual funds, exchange-traded funds (ETFs), and indices have become popular among investors seeking to align their portfolios with ESG principles. These products offer a way to invest in companies that meet specific ESG criteria, allowing investors to support sustainable practices while pursuing financial returns.

Despite the positive momentum, ESG investing faces challenges. One concern is the potential for “greenwashing,” where companies may overstate their ESG credentials to attract investment. Ensuring that ESG claims are substantiated and verified is crucial for maintaining the integrity of sustainable investing.

Another challenge is the lack of standardized ESG metrics and reporting frameworks. The variability in ESG data and reporting standards can make it difficult for investors to compare and assess companies’ sustainability performance. Efforts to establish universal ESG standards and improve data consistency are ongoing.

In conclusion, the rise of ESG investing in 2023 reflects a growing focus on sustainability and responsible investment practices. As ESG factors continue to shape stock markets, investors and companies must navigate the evolving landscape with a commitment to transparency, accountability, and genuine sustainability.