Sustainable Investing: Trends and Challenges at the End of 2023

Sustainable investing has become a major focus for investors and financial institutions in 2023, driven by increasing awareness of environmental, social, and governance (ESG) issues. As the year comes to a close, understanding the trends and challenges in sustainable investing provides valuable insights into how this approach is influencing the financial world and what lies ahead for responsible investment practices.

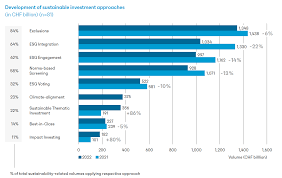

One of the significant trends in sustainable investing is the growing integration of ESG criteria into investment decisions. Investors are increasingly seeking to align their portfolios with sustainable practices, emphasizing companies that demonstrate strong environmental stewardship, social responsibility, and robust governance. This trend reflects a broader recognition of the financial materiality of ESG factors and the desire to mitigate risks associated with unsustainable practices.

The rise of green bonds and other sustainable financial instruments has been notable in 2023. Green bonds, which fund projects with positive environmental impacts, have gained popularity as investors look for ways to support climate-friendly initiatives. Similarly, social bonds and sustainability-linked loans have emerged as tools for financing projects that address social issues or promote sustainable development goals.

Despite the positive momentum, sustainable investing faces several challenges. One major issue is the lack of standardized ESG metrics and reporting frameworks. The variability in ESG data and reporting standards can make it difficult for investors to assess and compare the sustainability performance of different companies. Efforts to establish universal ESG standards and improve transparency are ongoing, but progress has been uneven.

Another challenge is the risk of “greenwashing,” where companies may exaggerate or misrepresent their sustainability efforts to attract investors. Ensuring that investments genuinely contribute to positive environmental or social outcomes requires robust due diligence and verification processes. Investors must remain vigilant and seek out credible sources of information to avoid falling prey to misleading claims.

Regulatory developments are also shaping the landscape of sustainable investing. Governments and regulatory bodies are increasingly introducing policies that mandate ESG disclosures and promote sustainable finance. These regulations aim to enhance transparency and accountability, but they can also create compliance challenges for companies and investors.

As we approach the end of 2023, sustainable investing continues to evolve, driven by growing investor demand and regulatory pressures. The focus on ESG factors is expected to persist, with ongoing efforts to address challenges and enhance the effectiveness of sustainable investment practices. Understanding these trends and challenges is essential for investors looking to navigate the evolving landscape of responsible investing.